Do you ever wake up in the middle of the night because your brain decides now is the perfect time to freak out about your finances? Yeah, same.

A couple of years ago, I was launching my business, and I figured, Hey, I’ve got great personal credit—why not just use that for everything? Fast forward six months, and my personal credit was getting KO’d like a fighter who walked into the wrong ring. That’s when I learned the hard way: business credit and personal credit are NOT the same thing. Understanding the difference could be the difference between a thriving business and a financial headache that follows you for years. So, let’s break it down—no corporate mumbo jumbo, just the real talk you need.

What Is Personal Credit (and Why You Shouldn’t Rely on It for Business)?

Personal credit is like your financial reputation. It’s what lenders, landlords, and even some employers use to decide if they can trust you with money.

It’s based on things like:

Your credit card usage (aka, do you max it out every month?)

Your payment history (paying late is the financial equivalent of ghosting—never a good look)

Your credit mix (loans, cards, mortgages, etc.)

Credit inquiries (how often you apply for new credit)

Now, when I started my business, I made the classic rookie mistake—I put everything on my personal credit. New laptop? Personal credit card. Business supplies? Personal credit card. Emergency expenses? You get the idea.

Before I knew it, my credit utilization shot up, my score dropped, and suddenly, my personal finances were at risk because of my business spending. (10/10 do not recommend.)

Business Credit: Your Company’s Financial Identity

Here’s where business credit comes in clutch. Think of it like your company’s personal credit score—it exists separately from you (when set up correctly).

Business credit is built on:

Your company’s payment history with vendors and suppliers

Credit accounts in your business’s name (not yours!)

Your relationship with lenders and creditors

How long your business has been financially active

The biggest perk? It protects your personal credit.

When you establish strong business credit, you can:

Get business loans without using your personal credit as a guarantee

Secure higher credit limits (way more than personal cards)

Build financial credibility so vendors want to work with you

Basically, instead of you being on the hook for everything, your business starts standing on its own two feet financially.

How to Build Business Credit the Smart Way

Okay, so now you get why business credit matters. But how do you actually build it? Here’s the playbook:

Step 1: Make Your Business Legit

Get an LLC or Corporation (sole proprietors, this isn’t gonna work as well for you)

Apply for an EIN (Employer Identification Number)—this is like your business’s Social Security Number

Open a business bank account (yes, separate from your personal one—no mixing allowed)

Step 2: Get Listed Where It Counts

Apply for a DUNS Number from Dun & Bradstreet (it’s free, and it’s a must-have)

Make sure your business is listed with Experian Business & Equifax Business

Use your business address & phone number—lenders don’t love P.O. boxes and personal cell numbers

Step 3: Start with Easy Credit

Open Net-30 accounts with vendors that report to business credit bureaus (Uline, Grainger, Quill—these are great starter accounts)

Get a business credit card (ones from Brex or Divvy don’t require a personal guarantee)

Use a business fuel card if you drive for work (WEX and Shell have solid options)

Step 4: Pay On Time (Or Earlier!)

Never, ever miss a payment—it’ll wreck your business credit faster than bad Yelp reviews

Pay vendors early if possible (some only report early payments)

Step 5: Scale Up

After 6 months of good business credit history, apply for store credit cards (Amazon Business, Home Depot, etc.)After 12 months, apply for business lines of credit and actual business loans

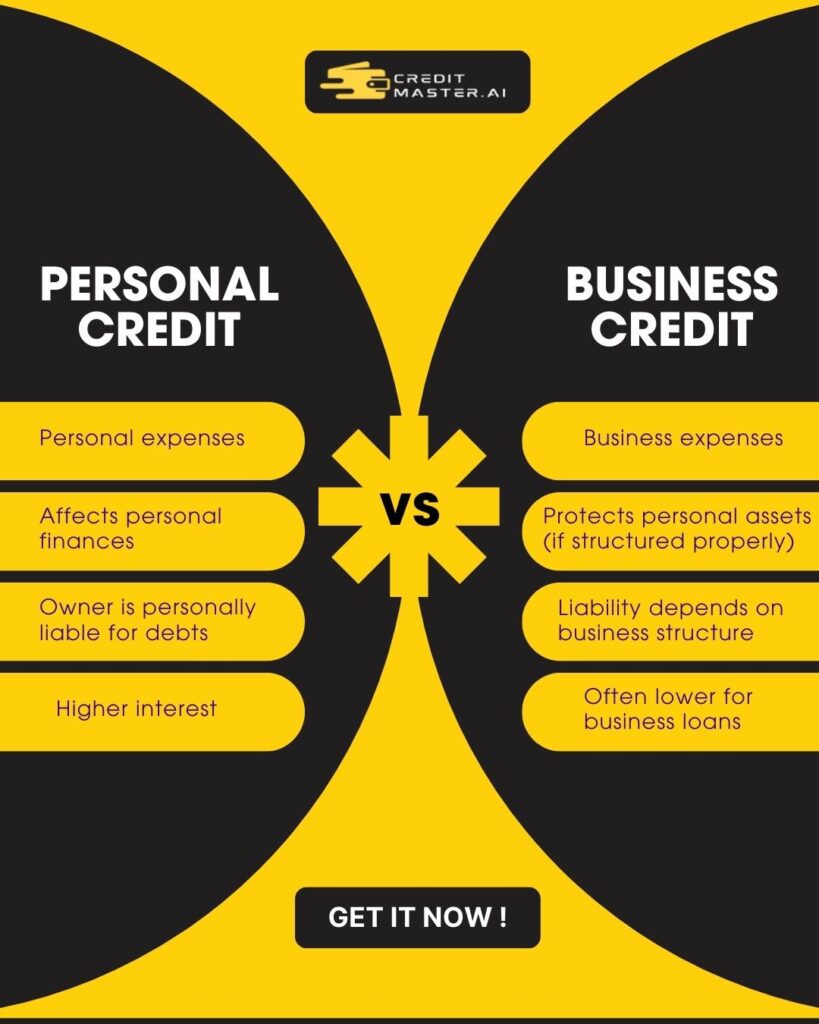

Business Credit vs. Personal Credit: Quick Cheat Sheet

| Feature | Personal Credit | Business Credit |

| Who it belongs to | YOU (personally) | Your BUSINESS |

| Credit score range | 300-850 | 0-100 (Paydex Score) |

| What affects it | Credit utilization, payment history, credit age | Payment history, business credit lines, vendor accounts |

| How to check it | Experian, Equifax, TransUnion | Dun & Bradstreet, Experian Business, Equifax Business |

| Risk if things go bad | Can ruin your personal finances | Stays separate from your personal credit (if no PG) |

| Perks | Can get personal loans & credit cards | Access to bigger credit lines, business loans, vendor financing |

Final Thoughts: Protect Your Personal Credit—Build Business Credit

If you take one thing from this, let it be this: Don’t let your business mess up your personal credit.

Your business should have its own credit, its own financial reputation, and its own ability to borrow money. The last thing you want is to max out your personal credit for business expenses and then struggle to get a car loan or a mortgage because of it.

So start today. Register your business, open the right accounts, and start building business credit now. Your future self will thank you—probably at 3 AM when they realize they don’t have to panic about their personal credit score anymore.

Now, tell me—are you using personal credit for business, or are you already on the business credit train? Let’s talk in the comments!